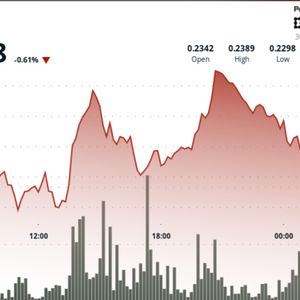

BitMine stock could surge if Ethereum breaks toward $5,000, since BitMine holds over 2.65 million ETH (estimated > $11B). A sustained ETH rally would likely re-rate BitMine’s equity given its crypto-heavy treasury and ongoing share buybacks. BitMine holds 2.65M+ ETH, valued at more than $11 billion — above its ~$9–9.2B market cap. Ethereum’s bullish flag pattern and support near $4,100 point to a potential move toward $5,000. BitMine’s share repurchases and treasury accumulation amplify upside if ETH rises; risk remains in market liquidity and demand. BitMine stock: analysis of Ethereum breakout potential and investor implications. Read the data-driven outlook and next steps for shareholders. What is driving BitMine stock’s potential rise? BitMine stock is primarily driven by its large Ethereum treasury and market exposure to ETH price moves. The company holds over 2.65 million ETH, creating a strong balance-sheet lever should Ethereum break to higher levels, while concurrent buybacks reduce outstanding shares and can lift per-share value. How could an Ethereum breakout to $5,000 affect BitMine? If Ethereum reaches $5,000, BitMine’s ETH holdings would be worth roughly $13.25 billion at current reported holdings. That valuation would materially exceed BitMine’s current market capitalization (~$9–9.2B), likely prompting a significant re-rating of the stock if realized and reflected in investor expectations. BitMine’s stock could rise significantly as Ethereum nears a strong breakout. The company holds over $11 billion in crypto assets. BitMine holds over $11 billion in Ethereum, significantly exceeding its $9 billion market cap. Ethereum’s bullish flag pattern suggests the cryptocurrency could break toward $5,000 in the near future. BitMine’s ongoing stock repurchases may enhance shareholder value amid a rising Ethereum price. BitMine (BMNR) stock shows signs of a potential bullish move driven by the company’s concentrated exposure to Ethereum (ETH). Management disclosures indicate a substantial ETH treasury that creates direct sensitivity to Ethereum price action. BitMine’s reported treasury includes more than 2.65 million ETH. At recent prices this was estimated at over $11 billion, which notably exceeds the company’s market capitalization near $9–9.2 billion. BitMine chairman Tom Lee has publicly expressed optimism on Ethereum’s structural role in finance and AI-driven decentralised applications, noting long-term value drivers. Why are Ethereum technicals pointing bullish? Ethereum has held above its 50-day moving average and key support near $4,106, forming a bullish flag continuation pattern. This setup typically signals a consolidation before continuation toward prior highs, with $4,950 and the $5,000 psychological level the next notable targets. Source: TradingView A successful breakout would translate to a higher mark-to-market for BitMine’s ETH holdings. Coupled with ongoing share repurchases, fewer outstanding shares could magnify per-share gains for holders. However, investors should weigh risks including ETH volatility, regulatory changes, and demand dynamics for miner/treasury stocks. How should investors evaluate BitMine’s risk and reward? Assess BitMine by separating intrinsic business operations from treasury exposure. The upside is large if ETH appreciates; downside is meaningful if ETH falls or illiquidity limits realizing treasury value. Monitor on-chain ETH metrics, TradingView technicals, and BitMine’s disclosed buyback cadence for signal confirmation. Frequently Asked Questions How many ETH does BitMine hold? BitMine holds over 2.65 million ETH, which recent estimates value at more than $11 billion based on prevailing market prices. Will BitMine’s buybacks affect shareholder value? Share repurchases reduce outstanding shares and can increase earnings per share and equity value, especially when combined with rising asset values like ETH. Key Takeaways Balance-sheet leverage : BitMine’s large ETH treasury creates asymmetric upside if Ethereum rises. Technical catalyst : Ethereum’s bullish flag and support levels point to a potential move toward $5,000. Risk management : Investors should track buybacks, on-chain ETH data, and market liquidity when sizing positions. Conclusion BitMine’s concentrated Ethereum holdings position the company to benefit materially from an ETH breakout. Investors should combine technical signals on Ethereum with BitMine’s buyback activity and treasury disclosures to form a data-driven view. For shareholders, the next weeks of price action in ETH will be a key determinant of BitMine stock performance. { "@context": "https://schema.org", "@type": "FAQPage", "mainEntity": [ { "@type": "Question", "name": "How many ETH does BitMine hold?", "acceptedAnswer": { "@type": "Answer", "text": "BitMine holds over 2.65 million ETH, which recent estimates place at more than $11 billion at current market prices." } }, { "@type": "Question", "name": "Could Ethereum rising to $5,000 boost BitMine stock?", "acceptedAnswer": { "@type": "Answer", "text": "Yes. If ETH reaches $5,000, BitMine’s ETH holdings would be valued near $13.25 billion, potentially prompting a significant re-rating of the company’s market capitalization." } } ]} { "@context": "https://schema.org", "@graph": [ { "@type": "NewsArticle", "headline": "BitMine Stock Could Rise as Ethereum Nears Bullish Breakout", "description": "BitMine’s large Ethereum treasury and share buybacks could drive a re-rating if ETH breaks toward $5,000. Data-driven outlook and investor considerations.", "image": ["https://en.coinotag.com/wp-content/uploads/2025/09/image-407-1024x541.png"], "datePublished": "2025-09-29T08:00:00Z", "dateModified": "2025-09-29T08:00:00Z", "author": { "@type": "Organization", "name": "COINOTAG", "url": "https://en.coinotag.com" }, "publisher": { "@type": "Organization", "name": "COINOTAG", "logo": { "@type": "ImageObject", "url": "https://en.coinotag.com/wp-content/uploads/2024/01/coinotag-logo.png" } }, "mainEntityOfPage": { "@type": "WebPage", "@id": "https://en.coinotag.com/bitmine-ethereum-breakout-analysis-2025" } }, { "@type": "HowTo", "name": "How to Evaluate BitMine Exposure to an Ethereum Breakout", "description": "Step-by-step checklist to assess BitMine’s risk and upside tied to Ethereum price action.", "step": [ { "@type": "HowToStep", "name": "Confirm ETH holdings", "text": "Verify BitMine’s disclosed ETH treasury (reported 2.65M+ ETH) and estimate mark-to-market value." }, { "@type": "HowToStep", "name": "Monitor ETH technicals", "text": "Watch support, 50-day MA, and flag patterns on TradingView to time potential breakout signals." }, { "@type": "HowToStep", "name": "Assess buyback impact", "text": "Track BitMine’s share repurchase cadence and compute the effect on outstanding shares and EPS." }, { "@type": "HowToStep", "name": "Stress-test scenarios", "text": "Model upside at ETH $5,000 and downside at key support levels to quantify potential valuation ranges." } ] } ]}

This Whale’s XRP Monster Buy Stuns XRP Army

This Whale’s XRP Monster Buy Stuns XRP Army