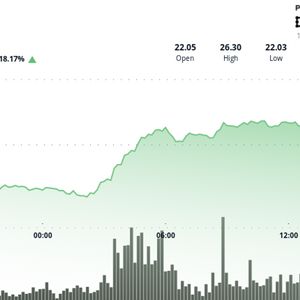

Chainlink’s LINK token jumped 18% to $26.05 on Sunday, according to CoinDesk Data, pacing the top 50 cryptocurrencies by percentage gain as analysts and traders cited momentum and recent fundamental catalysts. What Analysts Are Saying Altcoin Sherpa described LINK as “one of the best coins right now,” pointing to chart strength that could carry toward $30. He explained that round-number levels like $30 often act as psychological barriers where sellers take profits, so traders should be cautious about chasing the move too late. Zach Humphries, another analyst, argued that LINK remains “very undervalued” at current prices. He emphasized that Chainlink underpins much of decentralized finance by delivering the price feeds and cross-chain services many protocols rely on. From his perspective, the token should be treated as a bet on critical infrastructure rather than just another speculative asset. Milk Road highlighted the strong trading backdrop. The publication noted a 66% surge in 24-hour trading volume and said LINK’s clean breakout above $24.50 added conviction for momentum traders. They tied the bullish tone back to two key August developments: the launch of Chainlink’s new onchain reserve and its data partnership with Intercontinental Exchange (ICE). Chainlink Reserve On Aug. 7, Chainlink introduced the Chainlink Reserve , a smart contract treasury designed to steadily accumulate LINK over time. The mechanism works by converting the project’s revenue — paid in stablecoins, gas tokens, or fiat — into LINK and then locking those tokens onchain for multiple years. The conversion process, called Payment Abstraction, automates this workflow. It uses Chainlink’s own services — price feeds for fair conversion rates, automation to trigger transactions, and CCIP to consolidate fees from different chains — before swapping into LINK via decentralized exchanges. Chainlink says the Reserve has already accumulated more than $1 million worth of LINK, with no withdrawals planned for several years. It also earmarks 50% of fees from staking-secured services such as Smart Value Recapture to feed the Reserve, creating a recurring stream of inflows. The initiative serves two strategic purposes. First, it strengthens the link between adoption and token demand by ensuring usage revenues convert directly into LINK. Second, it provides transparency: anyone can view inflows, balances, and the timelock at reserve.chain.link . Chainlink has framed the Reserve as one piece of a broader economic design that includes user-fee growth and cost reductions via the Chainlink Runtime Environment. For investors, the practical takeaway is that network growth can now translate into steady, programmatic accumulation of LINK on the open market. Chainlink’s dashboard shows the reserve now holds about 109,663 LINK tokens, with a market value of roughly $2.8 million. The data also highlights that the average cost basis of these holdings is $19.65 per token, underscoring the program’s early accumulation strategy. ICE Partnership On Aug. 11, Chainlink announced a partnership with Intercontinental Exchange (ICE), the operator of the New York Stock Exchange. The collaboration integrates ICE’s Consolidated Feed, which provides foreign-exchange and precious-metals rates from more than 300 venues, into Chainlink Data Streams. ICE is one of several blue-chip contributors to these datasets, which are aggregated by Chainlink to create fast, tamper-resistant data feeds for use onchain. By incorporating ICE’s market coverage, Chainlink aims to make its feeds more attractive for banks, asset managers, and developers building tokenized assets or automated settlement systems. Chainlink Labs described the integration as a watershed moment for institutional adoption. The thinking is that traditional finance players need proven, high-quality data to interact with blockchain applications, and bringing ICE’s feeds onchain helps meet that standard. The partnership marked one of the clearest examples yet of a major Wall Street market data provider engaging with blockchain infrastructure. By giving decentralized applications direct access to ICE’s financial data, it positioned Chainlink as a bridge between traditional markets and decentralized finance. Looking Ahead Analysts highlight LINK’s strong trend, undervaluation and accelerating momentum, suggesting the token is in a position of strength as investors digest Chainlink’s recent strategic moves.

Pundit: This Is Why They Shit on XRP

Pundit: This Is Why They Shit on XRP